It’s an obvious statement that auto insurance companies don’t want policyholders to shop around. Consumers who perform rate comparisons will presumably move their business because of the high probability of finding a cheaper policy. A study showed that drivers who compared rates once a year saved $865 annually compared to other drivers who never shopped around for cheaper prices.

It’s an obvious statement that auto insurance companies don’t want policyholders to shop around. Consumers who perform rate comparisons will presumably move their business because of the high probability of finding a cheaper policy. A study showed that drivers who compared rates once a year saved $865 annually compared to other drivers who never shopped around for cheaper prices.

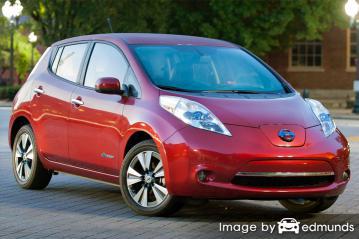

If finding the most affordable Nissan Leaf insurance is your objective, then having some knowledge of how to find and compare insurance rates can help simplify the task of finding more affordable coverage.

Really, the only way to get budget Nissan Leaf insurance is to annually compare prices from insurance carriers that insure vehicles in Madison. Rate comparisons can be done by following these guidelines.

First, gain an understanding of what is in your policy and the things you can control to prevent expensive coverage. Many policy risk factors that increase rates like accidents, traffic tickets, and a not-so-good credit rating can be amended by making lifestyle changes or driving safer. Read the full article for the details to find cheap rates and get additional discounts.

Second, compare prices from independent agents, exclusive agents, and direct companies. Direct and exclusive agents can only give prices from a single company like Progressive or Allstate, while agents who are independent can provide rate quotes from multiple insurance companies.

Third, compare the new rate quotes to your existing rates to see if a cheaper rate is available in Madison. If you find better rates and make a switch, ensure there is no coverage lapse between policies.

Fourth, notify your agent or company to cancel your current coverage. Submit a completed policy application and payment for the new coverage. Immediately safely store the proof of insurance certificate in your vehicle’s glove compartment or console.

One key aspect when comparing rates is to use the same liability limits and deductibles on each quote and to quote with as many auto insurance providers as possible. This helps ensure the most accurate price comparison and a complete price analysis.

Locating the best rates in Madison is not rocket science. If you currently have a car insurance policy, you should be able to save money using the techniques covered below. Nevertheless, Wisconsin car owners can benefit by having an understanding of how the larger insurance companies sell insurance online because rates fluctuate considerably.

The quickest method we recommend to compare car insurance company rates for Nissan Leaf insurance in Madison is to know car insurance companies will pay a fee to compare rate quotes. All consumers are required to do is give the companies some data like if you went to college, an estimate of your credit level, deductibles desired, and which vehicles you own. That rating data is then sent to multiple insurance providers and you receive quotes instantly.

To compare multiple company lower-cost Nissan Leaf insurance rates now, click here and enter your coverage details.

The auto insurance companies shown below have been selected to offer quotes in Wisconsin. If you want the cheapest car insurance in Madison, it’s a good idea that you click on several of them to get a more complete price comparison.

Why you need insurance for your Nissan vehicle

Despite the potentially high cost of Nissan Leaf insurance, buying insurance serves an important purpose.

- Most states have minimum mandated liability insurance limits which means the state requires a minimum amount of liability if you don’t want to risk a ticket. In Wisconsin these limits are 25/50/10 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If you bought your Nissan with a loan, almost all lenders will stipulate that you carry insurance to guarantee payment of the loan. If the policy lapses, the lender may have to buy a policy to insure your Nissan at a significantly higher premium and require you to fork over the higher premium.

- Insurance protects your Nissan Leaf and your assets. It will also pay for hospital and medical expenses for you, your passengers, and anyone else injured in an accident. Liability coverage also pays for attorney fees and expenses if someone files suit against you as the result of an accident. If your car is damaged in a storm or accident, your insurance policy will pay to repair the damage.

The benefits of buying insurance definitely exceed the price paid, particularly for liability claims. An average driver in America is overpaying over $800 each year so compare rate quotes once a year at a minimum to ensure rates are competitive.

Car insurance discounts help lower rates for Nissan Leaf insurance in Madison

Some providers don’t always list the entire discount list very well, so the list below gives a summary of some of the more common and also the lesser-known credits available to lower your premiums when you buy Madison car insurance online.

- One Accident Forgiven – Not really a discount, but a handful of insurance companies will forgive one accident before raising your premiums if you are claim-free for a certain period of time.

- College Student Discount – Children living away from Madison attending college and do not take a car to college may qualify for this discount.

- Defensive Driver – Taking part in a defensive driver class could possibly earn you a 5% discount and make you a better driver.

- Claim-Free Discount – Drivers who don’t have accidents are rewarded with significantly better rates on Madison car insurance quote in comparison to accident-prone drivers.

- Early Payment Discounts – If you can afford to pay the entire bill rather than paying monthly you could save up to 5%.

- Service Members Pay Less – Being on active duty in the military can result in better rates.

- Senior Citizen Rates – Mature drivers may receive reduced rates.

- Early Signing – Some insurance companies provide a discount for switching companies prior to the expiration date on your current Leaf insurance policy. You can save around 10% with this discount.

- Drive Safe and Save – Accident-free drivers can save up to 40% or more on their Madison car insurance quote than drivers with accident claims.

- Seat Belts Save – Buckling up and requiring all passengers to use their safety belts can save up to 10 percent (depending on the company) off the PIP or medical payment premium.

Keep in mind that some of the credits will not apply to the entire cost. Most only cut the cost of specific coverages such as liability, collision or medical payments. Despite the appearance that adding up those discounts means a free policy, it’s just not the way it works.

To find insurers that offer the discounts shown above in Madison, click this link.

Local Madison auto insurance agents

Many people just prefer to buy from a licensed agent and doing that can be a smart decision The best thing about price shopping on the web is that you can obtain lower car insurance rates and still have an agent to talk to.

To find an agent, once you fill out this form (opens in new window), the quote information is sent to companies in Madison that provide free Madison car insurance quotes for your business. It’s much easier because you don’t need to search for an agent since price quotes are sent to the email address you provide. You’ll get the best rates and work with a local agent. If you wish to get a rate quote from a specific company, you would need to go to their quote page to submit a rate quote request.

Picking the best provider requires you to look at more than just the quoted price. These questions are important to ask:

- Is assistance available after office hours?

- How is replacement cost determined on your vehicle?

- Is there a Errors and Omissions policy in force?

- Do they assist clients in filing claims?

- Are all drivers listed on the coverage quote?

- Is insurance their full-time profession?

- Are aftermarket or OEM parts used to repair vehicles?

If you are wanting to find a reliable insurance agency, you need to know there are two different types of agencies and how they operate. Insurance agents in Madison can be categorized as either exclusive agents or independent agents.

Exclusive Agents

Exclusive agents can only write with one company and examples are Allstate, Farmers Insurance or State Farm. They are unable to place coverage with different providers so you need to shop around if the rates are high. They are usually well trained on what they offer which can be an advantage.

Listed below are Madison exclusive insurance agencies that are able to give price quote information.

Allstate Insurance Agent: George McDevitt

4706 Cottage Grove Rd Ste 300 – Madison, WI 53716 – (608) 222-2411 – View Map

Farmers Insurance: Jesus Carvajal

5555 Odana Rd #201 – Madison, WI 53719 – (608) 278-7055 – View Map

American Family Insurance – Brad Bodden

3821 Nakoma Rd – Madison, WI 53711 – (608) 231-2453 – View Map

Independent Insurance Agencies

Independent insurance agents do not work for one specific company and that gives them the ability to insure with an assortment of companies depending on which coverage is best. To move your coverage to a new company, your agent can just switch to a different company and you don’t have to switch agencies.

When shopping rates, you should always include rate quotes from at least one independent agent so that you have a good selection of quotes to compare.

Listed below are Madison independent insurance agencies that can give you price quote information.

Stainbrook Agency

2810 Crossroads Dr #4000 – Madison, WI 53718 – (608) 535-9291 – View Map

Johnson Insurance

525 Junction Rd #2000 – Madison, WI 53717 – (608) 203-3880 – View Map

Red Barn Insurance Agency

6666 Odana Rd – Madison, WI 53719 – (608) 467-6804 – View Map

Compare auto insurance rates regularly to save

Affordable Nissan Leaf insurance in Madison is attainable on the web and from local insurance agents, so you need to quote Madison car insurance with both in order to have the best price selection to choose from. Some companies may not provide the ability to get a quote online and usually these regional insurance providers prefer to sell through local independent agencies.

While you’re price shopping online, do not skimp on coverage in order to save money. There are a lot of situations where an insured dropped liability coverage limits and learned later that saving that couple of dollars actually costed them tens of thousands. Your goal should be to purchase a proper amount of coverage at the best price, but don’t skip important coverages to save money.

More information

- When is the Right Time to Switch Car Insurance Companies? (Allstate)

- What Car Insurance is Cheapest for Felons in Madison? (FAQ)

- Who Has Cheap Madison Car Insurance Quotes for Electric Cars? (FAQ)

- Who Has the Cheapest Auto Insurance for Used Cars in Madison? (FAQ)

- Who Has Affordable Auto Insurance Quotes After a Speeding Ticket in Madison? (FAQ)

- If I File a Claim will My Insurance Go Up? (Insurance Information Institute)

- Higher speed limits cause more fatalities (Insurance Institute for Highway Safety)

- Get the Right Protection (InsureUonline.org)