If you want to save money, the best way to save money on auto insurance rates in Madison is to compare quotes once a year from providers who provide car insurance in Wisconsin. Rates can be compared by completing these steps.

If you want to save money, the best way to save money on auto insurance rates in Madison is to compare quotes once a year from providers who provide car insurance in Wisconsin. Rates can be compared by completing these steps.

- Read and learn about how auto insurance works and the steps you can take to keep rates down. Many factors that result in higher rates such as speeding and a negative credit history can be remedied by making small lifestyle or driving habit changes. Later in this article we will cover ideas to find cheap rates and get discounts that may be overlooked.

- Compare prices from independent agents, exclusive agents, and direct companies. Direct companies and exclusive agencies can only provide price estimates from one company like Progressive or Farmers Insurance, while agents who are independent can provide price quotes from many different companies.

- Compare the quotes to the premium of your current policy to see if cheaper RC F coverage is available. If you find a better price and decide to switch, make sure there is no coverage gap between policies.

An essential thing to point out is to make sure you’re comparing the same liability limits and deductibles on each price quote and and to get quotes from as many car insurance companies as possible. This enables an accurate price comparison and a better comparison of the market.

Unthinkable but true, most consumers have purchased from the same company for well over three years, and virtually 40% of consumers have never even compared rates from other companies. Madison drivers could save themselves 30% a year just by getting comparison quotes, but most tend to underestimate the amount of money they would save if they swap their current policy for a cheaper one.

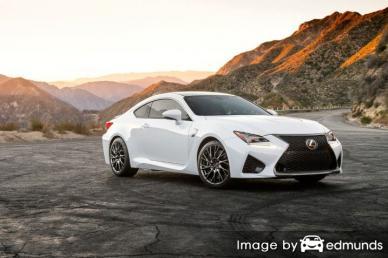

Companies offering Lexus RC F insurance in Wisconsin

The companies shown below have been selected to offer quotes in Wisconsin. To buy cheap car insurance in Wisconsin, we suggest you get prices from several of them in order to find the most affordable rates.

Get discounts to get affordable Madison auto insurance rates

Auto insurance can be pricey, but you may find discounts to reduce the price significantly. A few discounts will automatically apply when you quote, but occasionally some discounts must be requested specifically prior to receiving the credit.

- Discount for Good Grades – Maintaining excellent grades may save you up to 25%. Most companies allow this discount well after school through age 25.

- Lower Rates for Military – Being deployed in the military may lower your premium rates slightly.

- Low Mileage Discounts – Driving fewer miles may enable drivers to earn cheaper auto insurance rates.

- Seat Belt Usage – Using a seat belt and requiring all passengers to buckle their seat belts can save 10% or more on the premium charged for medical payments and/or PIP.

- Multi-policy Discount – If you can combine your home and auto policy with one insurance company you may save at least 10 to 15 percent or more.

- Membership in Organizations – Having an affiliation with a qualifying organization can get you a small discount on your policy.

- Multi-line Discount – Some companies give a lower price if you buy auto and life insurance together.

- Telematics Data – Drivers who elect to allow their company to analyze driving habits by using a telematics device like Drivewise from Allstate or In-Drive from State Farm could save a few bucks if they have good driving habits.

Just know that many deductions do not apply to the whole policy. A few only apply to the cost of specific coverages such as comp or med pay. Despite the fact that it seems like all the discounts add up to a free policy, you’re out of luck. But any discount will lower your overall bill.

A few companies that may have some of the discounts shown above include:

- GEICO

- Mercury Insurance

- Farmers Insurance

- Auto-Owners Insurance

- Liberty Mutual

- SAFECO

- Progressive

- USAA

Double check with all the companies which credits you are entitled to. A few discounts may not apply to policyholders in Madison. To see a list of insurers who offer online Lexus RC F insurance quotes in Madison, click this link.

Insurance agent or online?

Many people would prefer to visit with an insurance agent and that can be a smart move Professional insurance agents can help you build your policy and will help you if you have claims. One of the benefits of comparing insurance prices online is the fact that you can find cheap rate quotes but also keep your business local. Supporting local agencies is important especially in Madison.

After completing this simple form, your insurance coverage information is transmitted to insurance agents in Madison who will gladly provide quotes for your business. There is no need to leave your house since rate quotes are delivered immediately to your email address. In the event you want to compare prices from a particular provider, you can always navigate to their website and complete a quote there.

After completing this simple form, your insurance coverage information is transmitted to insurance agents in Madison who will gladly provide quotes for your business. There is no need to leave your house since rate quotes are delivered immediately to your email address. In the event you want to compare prices from a particular provider, you can always navigate to their website and complete a quote there.

Picking the best insurance company should include more criteria than just the bottom line cost. Below are some questions you should ask.

- Do clients work directly with the agent or are most inquiries handled by a CSR?

- Will they make sure you get an adequate claim settlement?

- Does the agency have a good rating with the Better Business Bureau?

- Are claim adjusters local or do you have to take your car somewhere else?

- Do they review policy coverages at every renewal?

- How many companies do they write for?

- Is their price quote a firm figure or are their hidden costs?

What car insurance coverages do you need?

Learning about specific coverages of your policy helps when choosing the best coverages for your vehicles. Car insurance terms can be confusing and even agents have difficulty translating policy wording. These are the normal coverages found on most car insurance policies.

Liability car insurance

This provides protection from damage or injury you incur to other people or property that is your fault. It protects you against other people’s claims, and doesn’t cover your injuries or vehicle damage.

Coverage consists of three different limits, bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. Your policy might show limits of 25/50/10 which stand for a limit of $25,000 per injured person, a per accident bodily injury limit of $50,000, and property damage coverage for $10,000. Some companies may use one number which is a combined single limit which provides one coverage limit and claims can be made without the split limit restrictions.

Liability insurance covers claims such as medical services, funeral expenses and repair bills for other people’s vehicles. How much coverage you buy is up to you, but it’s cheap coverage so purchase as large an amount as possible. Wisconsin state law requires minimum liability limits of 25/50/10 but it’s recommended drivers buy more coverage.

The chart below demonstrates why buying low liability limits may not be adequate coverage.

Collision protection

This coverage covers damage to your RC F resulting from colliding with another vehicle or an object, but not an animal. A deductible applies and then insurance will cover the remainder.

Collision coverage pays for things such as crashing into a ditch, rolling your car and colliding with another moving vehicle. Collision coverage makes up a good portion of your premium, so consider removing coverage from vehicles that are 8 years or older. It’s also possible to choose a higher deductible on your RC F in order to get cheaper collision rates.

Insurance for medical payments

Medical payments and Personal Injury Protection insurance kick in for expenses such as nursing services, hospital visits, ambulance fees and prosthetic devices. They are used to fill the gap from your health insurance program or if you do not have health coverage. It covers both the driver and occupants in addition to any family member struck as a pedestrian. PIP coverage is not an option in every state and may carry a deductible

Uninsured Motorist or Underinsured Motorist insurance

Your UM/UIM coverage gives you protection when the “other guys” either have no liability insurance or not enough. This coverage pays for medical payments for you and your occupants as well as damage to your Lexus RC F.

Since a lot of drivers only purchase the least amount of liability that is required (25/50/10), it only takes a small accident to exceed their coverage. This is the reason having UM/UIM coverage should not be overlooked. Normally the UM/UIM limits are similar to your liability insurance amounts.

Comprehensive coverage (or Other than Collision)

Comprehensive insurance pays to fix your vehicle from damage from a wide range of events other than collision. You need to pay your deductible first then the remaining damage will be covered by your comprehensive coverage.

Comprehensive coverage protects against claims such as hitting a bird, damage from getting keyed, fire damage, rock chips in glass and theft. The maximum payout a car insurance company will pay at claim time is the cash value of the vehicle, so if the vehicle’s value is low consider dropping full coverage.

More quotes mean more auto insurance savings

In this article, we covered quite a bit of information on how to lower your Lexus RC F insurance premium rates in Madison. The key thing to remember is the more companies you get prices for, the better your comparison will be. You may even find the most savings is with some of the smallest insurance companies. These smaller insurers can often insure niche markets at a lower cost compared to the large companies like State Farm and Allstate.

As you quote Madison auto insurance, make sure you don’t reduce coverage to reduce premium. In many instances, an insured dropped comprehensive coverage or liability limits only to discover later that saving that couple of dollars actually costed them tens of thousands. The proper strategy is to purchase a proper amount of coverage at the best price, but do not skimp to save money.

Additional information is available at the links below

- Crash Avoidance Technologies FAQ (iihs.org)

- Who Has Cheap Auto Insurance Quotes for Inexperienced Drivers in Madison? (FAQ)

- Who Has Affordable Auto Insurance for a Ford Fusion in Madison? (FAQ)

- Who Has the Cheapest Car Insurance for Drivers Over Age 60 in Madison? (FAQ)

- Cellphones, Texting and Driving (iihs.org)

- Auto Insurance 101 (About.com)

- Comprehensive Coverage (Liberty Mutual)

- Distracted Driving Extends Beyond Texting (State Farm)